Thinking About Smart Home Payments? Go For Voice-Driven Commerce

- March 30, 2022

- by Ezlo Admin

If you want your customers to pay for additional features of your product, voice assistants can help you with that.

One of the major disadvantages of smart home devices is the one-time fee you as a business earn for your product.

You invest a lot of effort to develop hardware and software and set up the infrastructure requiring constant maintenance. Customers pay you only once for your sensor, smart doorbell, or thermostat, though you keep improving it by releasing firmware updates and providing technical support.

That’s why many manufacturers think about how can they offer value-added services for an additional fee or even motivate users to switch to a recurring payment model.

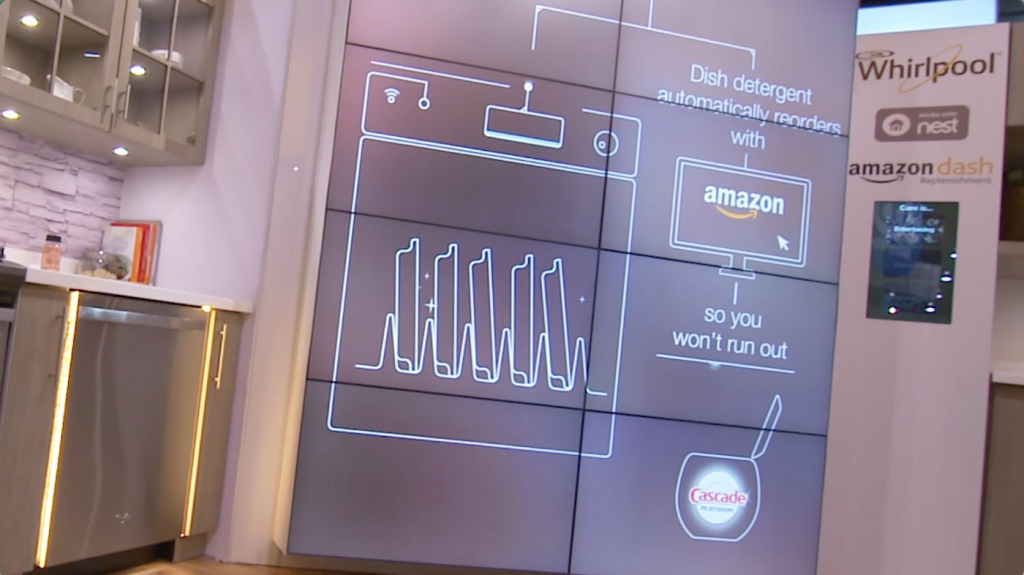

Examples? You may have already heard about smart home devices helping users to replenish their supplies. Samsung’s Hub refrigerator has interior cameras to analyze the stock and let users buy necessary items from a partnering grocery within its app. Some Whirlpool washing machines come with Amazon Dash to allow users to refill laundry detergents automatically.

The manufacturer in these cases, of course, gets a percentage from a transaction as a middleman.

But other approaches are also possible.

For instance, customers can pay an additional fee to get a specific set of recipes or presets for a smart oven, or some space in cloud storage to keep their surveillance camera recording video 24/7, and so on.

And this is where the problem comes in: How to implement a payment feature?

At least three options are available here.

1. Built-in payment module

You can build a payment system right into your product. Think of Amazon Dash. One button to make a specific purchase. Here are the pitfalls of this solution:

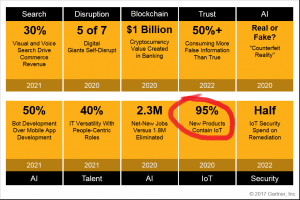

Security issues

IoT devices are still too vulnerable today. Users can be skeptical about solutions having access to their e-wallets. Customers with kids would also probably prefer to not make it possible for their children to make automated payments.

Complicated self-diagnostics

How a user can be sure that the payment has been processed? What if the connection was terminated during data transfer, what’s then? When the ordered stuff is going to be delivered?

If the process is unintuitive and unclear at every step, that may frustrate your customers.

Technical implementation

Building a payment processing system as a part of your product from scratch may turn out to be a pain in the neck.

With mobile, there are some ready-to-go solutions. IoT, they are still in its infancy:

- There’s yet an unreleased Google’s Android Things OS, and TOS/TOS+, an operating system from a leading Chinese tech company that has payment capabilities which probably will require you to redesign your solution to make them compatible.

- You may have also heard of Qualcomm’s SoCs that come with NXP’s eSE, embedded secure elements ensuring transaction security.

In both cases, your product will require significant updates to either be compatible with the above-mentioned OS or get a Qualcomm SoC onboard.

2. In-app purchases

The simplest way to implement payments is in-app purchases inside your product’s companion app. That’s an optimal solution because transaction security is already provided and guaranteed by Apple and Google.

But what if your smart home device does not require a full-fledged mobile companion app?

3. Voice-driven payments

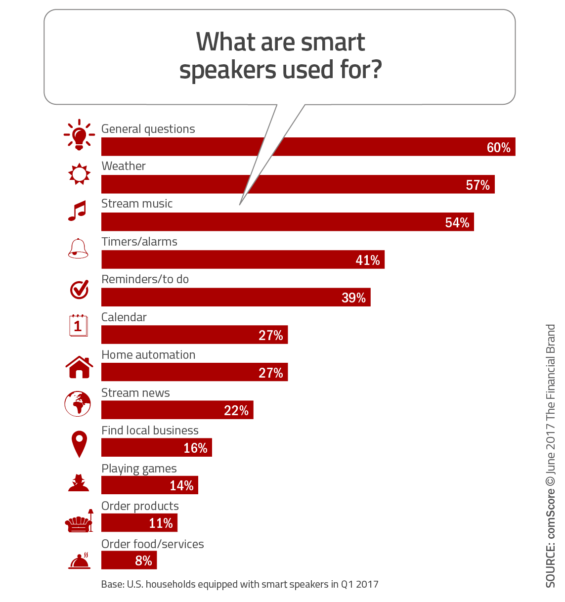

The era of voice-driven digital assistants is on the rise. Just take a look at these numbers:

- 75% of those who own an iPhone using Siri, and 63% of users owning an Android device have used a virtual assistant on it (Pew Research Center)

- at least 11% of smart speakers use them to order products, while 8% order food and services (comScore via Financial Brand)

- 18 million US have already made at least one voice payment. And that figure is expected to grow further with a 31% compound annual rate up to 2023 (BI Intelligence)

If you have doubts regarding your customer’s readiness to make voice payments, here’s a beautiful example: in India, where millions of people still struggle with typing and operating smartphones, voice directions become their salvation for digital payments. After all, we all find talking a more natural process than handling new technologies.

And while Amazon, Google and Apple are already fighting for the presence of their voice assistants in our households, it’s just about time for smart home device manufacturers to make sure their products are compatible with these assistants and allow voice-directed payments.

Just imagine these commands:

- Alexa, order another smart plug from %your_brand%

- OK Google, activate cloud storage for my baby watcher

- Hey Siri, get this $5 package of automation personalized for me

And enabling them is much easier than setting up a payment module from scratch from the developers’ point of view.

Sure, enabling such commands is not enough to increase sales and your income. Users should be properly motivated to pay you more. But that’s a completely different story.

See Also